The Cost to Farm: Skyrocketing Inflation and How Aggies Mitigate These Costs

Author

Published

4/24/2024

Last Friday, KTAR’s Mike Broomhead producer, Julia Sorgie, reached out to me and asked if I could come on the show and talk about inflation on the farm. We set Monday, April 22nd, as the studio date and I went in to discuss a very tough issue in farm and ranch country.

Mr. Broomhead was a gracious guy and imparted to me his fondness for the agriculture industry. So, good to know we have an advocate in the media business. And he wanted to know what farmers are facing and how they are dealing with the high cost to farm.

Starting with the well-known quote, “The farmer is the only person in our economy who must buy everything he buys at retail, sell everything he sells wholesale, and pay the freight both ways,” I first highlighted the long list of input costs the farmer must deal with on the farm.

Typical Input costs to Farm:

- Fertilizer

- Interest Expenses

- Pesticides

- Livestock

- Fuel & Oil

- Animal Feed

- Taxes

- Repair & Maintenance

- Marketing, storage and Transportation

- Seed

- Labor

- Rent

Input Costs for the 2024 growing season are expected to be the third-highest all-time, behind only 2022’s record-high and 2023’s second-all-time high. USDA predicts overall expenses will increase by 3.8%.

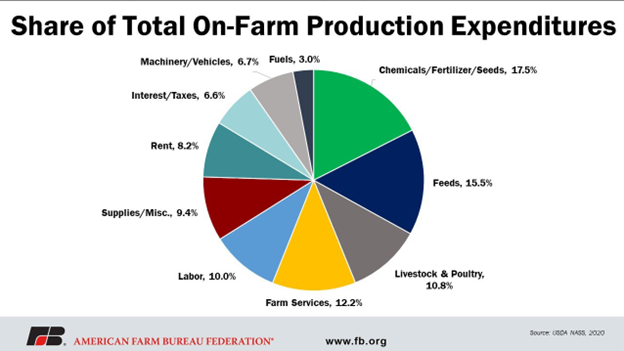

Share of Total On-Farm Production Expenditures/Graphic by AFBF

Example of the cost of doing business. Fertilizer is one of the major costs to farm.

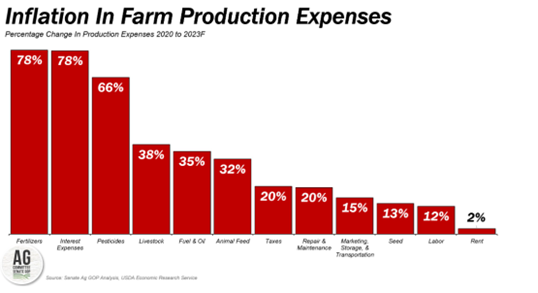

The graphic below was created by the Senate Ag GOP Analysis using USDA's Economic Research Service numbers.

One of the high-nitrogen fertilizers is UAN32. In 2022 it got as high as $725 a ton. It’s averaging around $600 a ton right now, according to several market reports I check on. When Murphree Farms farmed back in 2004 (our last year), I believe it was around $125 to $200 a ton.

Mr. Broomhead was a bit surprised that fuel and oil did show the biggest increase in inflation. But when you factor in where fertilizer comes from, its international footprint and how critical this input is to the mix of farming, you can understand the nearly 80% increase.

How Do Farmers Deal with the High Cost to Farm?

While a variety of strategies work and each farm and ranch business must approach differently their business plan for mitigating the high cost to farm, some basics apply. Of note, on the show I did not get to drill down on this and why I'm sharing some of the points here.

- Successful farmers and ranchers know their numbers: Yes, farmers should know the cost of production, but that’s just the start. Production costs can be used to calculate the farm’s profit margin. Profits are not the same as the taxable income farmers list on their tax returns.

- Hedge against inflation: This is difficult, and our predictive powers are not always the best, but some farmers have made a science out of successful hedging.

- Continue to find small efficiencies to cut out costs since they add up. One farmer once told me that he’s constantly looking “under the hood” of his business to work out efficiency and cut costs. “Certain costs I can actually control but I have to be proactive about the entire business and the hidden opportunities. Forever, farming has worked to reduce labor costs with automation, but this doesn’t mean the technology will be the best replacement if the technology cost is too prohibitive, for example.

- Pay down the right debt. This commentary comes from Farm Credit West and points out that paying off all debt outright in a heavy cash flow year could leave you hurting later down the road.

- Manage equipment costs. The business must always ask if it’s better to lease the equipment, especially for short-term use, or buy.

- Diversify the business. This one has great standing when you consider how agriculture commodity prices fluctuate so much.

- Expect cyclical ups and downs in farming and ranching and plan. When sensitive to this reality businesses will save and plan for the tough years when costs are high and commodity markets are down.

- Learn to anticipate. Some farmers will buy in bulk if they foresee a coming downturn in the commodity market and higher inflation.

- Scale. Many farms scale their business to mitigate the cost of doing business. Most believe this will continue. While farms become bigger, they are still family owned and operated, according to the USDA statistics on this.

When contemplating the future, many farmers expect fewer farms in the future, suggesting larger farms will continue.

The full clip is below.