What's On Tap for the Global Protein Meat Market?

Author

Published

5/8/2024

I met Rupert Claxton, Meat and Livestock Director for Gira, last year at Iowa’s World Pork Expo on the state’s fairgrounds. Listening to his fascinating insights on global meat markets, I knew I had to ask him to participate in our conversation series of thought leaders in the agriculture sector.

Claxton has worked as a strategy consultant in the food sector since joining Gira in 2003, with a high level of specialization in global meat and livestock markets. Gira is an independent food-focused consultancy company, founded in 1979, and working globally across the livestock, meat, dairy, and bakery supply chains.

Covering one of the most challenging and complex supply chains, Claxton spends a considerable amount of time analyzing the evolving nature of international meat demand and the supply systems that provide it, as well as their internal organization. For the last 20 years, he has produced the Asian sector of the annual Gira Meat Club report, and for the last 13 managed the Gira Asian Meat Club.

Claxton’s background in UK farming affords him a balanced outlook on the increasingly globalized meat industry, between the commercial drivers that control the processing industry and the complex cultural heritage that farming has evolved from.

Says Rupert Claxton, “The one thing for me that is globally true, is that the global meat industry must build better communication with the legislators and consumers of the world, otherwise others will do it for us!”

Arizona Agriculture: Please give us an update on world meat markets and what the future holds.

Claxton: Global meat markets are in recovery mode after a raft of complicated and overlapping issues: Asian Swine Flu (ASF), COVID-19, and the inflationary period of 2022-23 have all shaped global demand and consumer habits. The outlook for 2024 is more positive in general than 2023, with some cautious recovery in demand, as inflation slows, and consumers adjust to higher prices. This has been helped by a softening of feed prices.

There is little expectation of a jump in Chinese imports (price or volume) in 2024, but the Chinese economy is expected to start to improve in the second half of the year. This will support some growth, but nothing like the levels seen in 2020!

There are multiple challenges still facing the livestock sector, mostly stemming from profitability, but the potential risk of increased legislation is a key one when planning investments. Disruption from Animal disease is always an issue, and we are watching HPAI in Brazil closely, the knock-on of a commercial outbreak in central or Southern Brazil will have a global ripple.

In summary, improving, but is still fraught in the year ahead, as long as the Middle East situation doesn’t spiral into a region-wide event, then inflation should normalize, and demand will recover.

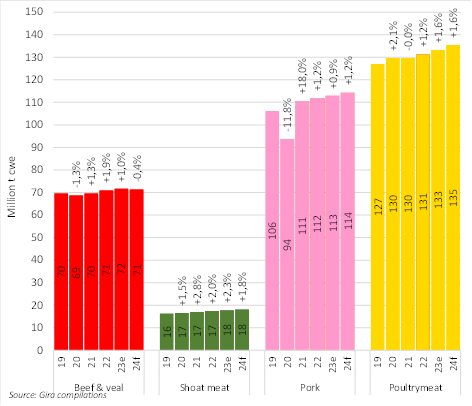

World Meat Production – 2019-24f

Arizona Agriculture: The world meat market, mostly due to input costs, is in a world of hurt. What else is challenging the market?

Claxton: While costs in the world meat market are a challenge, they have softened from the highs of 2022, although while feed costs have fallen, they are not back to the lows we have grown accustomed to. The major issue is the challenge of passing on those higher costs to the consumer. While costs have risen in livestock and meat production, they have also risen for the consumer, reducing their disposable incomes, and leading to a push for cheaper food, including meat. This also coincides with a slow Chinese economy, which has resulted in Chinese consumers reducing their meat expenditure, and reduced import pull from China for meat. The result is a supply balance that makes increasing prices hard.

You can then factor in the increased investment needs being seen in Europe and the U.S., with a push for higher animal welfare and increased sustainability, both trends that are here to stay, and will need to be factored into future investment plans.

Arizona Agriculture: Can you speak specifically to the pork market where you’ve done lots of research and analysis?

Claxton: We continue to do a lot of work on pork, both in the U.S., and on global markets. There are some really striking contradictions globally at the moment, and they are adding to some of the challenges in the U.S. pork industry. First up is the slower Chinese economy, and lower demand, compounded by their domestic pork production recovering from ASF (not to pre-ASF levels, but enough to satisfy the current weak market). This means import pull is limited, and Chinese buyers are paying lower prices, limiting the value to the world market, which built capacity for Chinese supply.

Then you have the European challenge, the pig cycle in Europe is out of line with the U.S., money was lost in Europe in 2021-22, and significant sow culls have taken place in 2022-23 and continue now. The result is far lower production, and higher prices, profitable at today’s feed levels but not driving a rebuilding of the breeding herd. A range of issues prevent reinvestment, environmental factors, aging famers, animal welfare changes and at the end of the day farm confidence. So, less EU pork, and higher European prices are set for now.

The U.S. is in the opposite position, still with too much production for a market that has faced inflationary challenges. The sharp sow cull seen in Europe hasn’t happened in the U.S., although there has been some, and so the readjustment in prices has yet to happen. The U.S. industry is in a position to wait out some of the storm, but that is prolonging the pain.

There are plenty of other challenges globally for the U.S. industry to face, including a weaker Japanese market in 2023, increasing Brazilian production, and the ever-present challenge of chicken!

Arizona Agriculture: In Europe, we’ve seen a lot of farmer demonstrations and protests. What’s your take on this and what about future impact?

Claxton: European farmers are backed into a really tight corner, huge pressure from NGOs and governments to make progress on sustainability and animal welfare, human density, making building large scale farms difficult if not impossible, manure regulations that mandate a reduction in livestock numbers in some regions, rising labor costs (if you can find it), high feed costs, very high energy costs and at the end of the day farm scales that cannot provide a competitive income.

The net result will be the loss of many small farms, and some limited scaling up through multi-sight systems (not single site as you see in the U.S.). It is likely to lead to restructuring of all the downstream industry, as scale is lost. And eventually, there is a need for some imports to balance supply!

Arizona Agriculture: What opportunities should American beef, poultry and pork producers be evaluating and preparing for?

Claxton: The U.S. industry has a scale advantage, and access to affordable feed, giving it one of the most competitive costs of production globally, despite the current challenges. The opportunity to play a role at a global level is obvious, but should focus on being a consistent quality supplier, not trying to beat the Brazilians on cost alone. But this will have to be done while driving increased environmental credentials, both for your domestic market, and eventually for export customers, although that is some way out yet.

Arizona Agriculture: From your global perspective, compare the European market to the U.S. market.

Claxton: That’s tough in a paragraph or two and is the easy subject of a report in its own right! But there are a few key points; First up is that the EU is not a single market from a meat perspective, but 27 national markets, with their own retailers and supply chain, along with a strong preference for their own national origin in raw meat, while in the U.S. you find regional variation, but the major packers are national. Europe is already prioritizing increased Animal Welfare standards, and environmental drivers are now becoming a common part of the decision-making process, while this is less mainstream in the U.S., but developing, and a look at where the EU is and is heading, would be good briefing for U.S. producers.

Both markets limit imports to protect domestic production, with quotas and tariffs as the main mechanism, but also the use of phytosanitary issues. Both have highly evolved modern supply chains, with a focus on providing choice to the consumer, and with that we see markets that are slanted towards serving the consumer, rather than the farmer and while we see in both markets a consumer detached from the farm, the Europeans have in general more focus on regional specializations in production standards, which still attract a premium, something I think is gaining interest in the U.S., although at a niche level.

Arizona Agriculture: Can the two markets complement each other more? Where do you see opportunities?

Claxton: There will always be some disagreement on production standards, the U.S. technology first approach and the Europeans slightly more conservative approach, as seen on hormones, carcass washes and beta agonists but these are distracting form the real opportunities, which largely center around carcass balance, some processed products, with regional specialization, and some of the higher welfare products.

On top of this, there is already a considerable industry based around technological development, in breeding, feed additives and farm and processing plant technology. In an industry under increasing pressure at a global level, it will be the ability to adopt the best technology and learn from the global market that will give some of the best benefits to the industry.

Arizona Agriculture: What can European producers teach Americans and vice versa?

Claxton: Some things don’t translate, but as above, the development of technology has been a core transatlantic trade for decades. The next 10 years will see a steep ramp-up in sustainability regulations and requirements across the industry. There are opportunities to learn from how these are implemented, and the solutions the industry can present for this.

Arizona Agriculture: How do we prepare for some of the future challenges coming down the road?

Claxton: The meat industry is a continually evolving market, at all levels from farm to fork. For me, the key is to not expect to be doing the same thing in 5 years as you are today.

Be prepared to adjust your working systems. At farm level, you should talk to those around you, the Danes have a long history of learning from each other, and it’s one of their core strengths today in pigs.

Arizona Agriculture: What have I not asked that I should?

Claxton: That’s a pretty good list of questions, there are no certainties in the world, but we should keep an eye on the disruptor technologies around our markets. Meat alternatives will develop, but how good can they become, and what is their real cost and environmental impact? What other technology can the livestock industry embrace to improve efficiency?

The one thing for me that is globally true, is that the global meat industry must build better communication with the legislators and consumers of the world, otherwise others will do it for us!

Editor's Note: This article originally appeared in the April issue of Arizona Agriculture.