When You Buy it, You Know It, You Can Sell It

Author

Published

9/11/2017

Rancher Jill Wilson needed crop insurance for her family’s X4 Ranch in Gila County, Arizona. She purchased Farm Bureau Financial Services’ (FBFS) crop insurance product, the pasture,

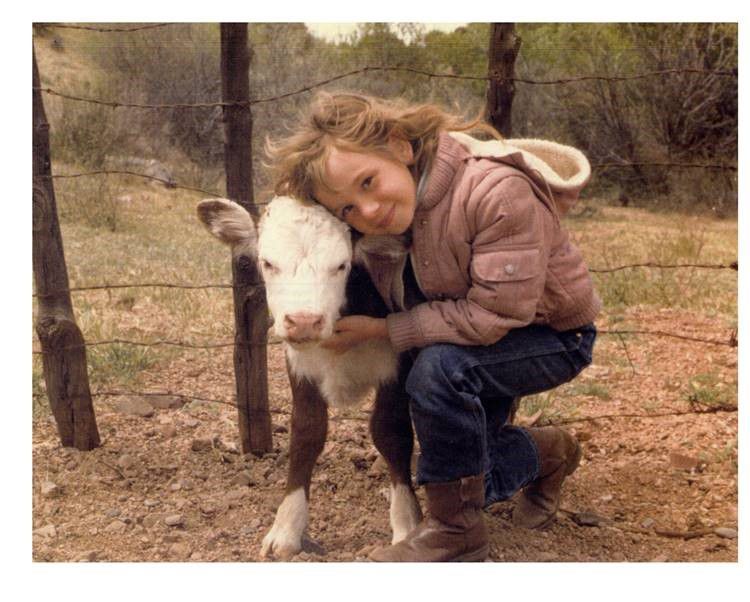

Jill as a little girl growing up on the ranch.

Wilson is also an FBFS agent. Perhaps one of its best kept secrets, Farm Bureau has offered crop and livestock insurance for its customers for some time through a partnership with Rain and Hail, a Chubb Company, headquartered in Johnston, Iowa. And, when Wilson discovered how robust the product was in protecting her own family’s ranch, she realized becoming certified to sell the crop insurance product only made sense.

“As a ranching family, and having purchased the pasture, range and forage product for 2016 personally, I saw the benefit to ranchers, as well as the demand that would be coming from neighbors,” says Wilson. “There wasn’t anyone in our state selling it (PRF) and our past PRF agent came from Texas, so I knew there would be a great opportunity for me to get in where I fit in.”

As Carla Stephenson, Director of Crop Marketing for FBFS explains, “With a lot of help from our crop insurance partners at Rain and Hail, Jill was able to obtain her certification on October 27, 2016, a short 19 days from the end of the sales period for this product. The amazing part of this story is how much business Jill wrote in those 19 days -- $3,391,952 on 22 policies.”

Now it’s 2017 and another November 15, 2017, deadline is looming for the pasture, range and forage coverage. But Wilson and other insurance agents are ready and focused on taking care of agriculture clients that need the coverage.

You need crop and livestock insurance and need a good product? Contact your FBFS agent. In the meantime, keep these 7 things in mind about crop and livestock insurance, according to FBFS.

1. Timing is everything: There are multiple important deadlines for purchasing crop insurance and completing farm duties to guarantee insurance coverage. Ask your Farm Bureau agent about sales closing dates for filing applications; you’ll also need to follow the acreage reporting date, earliest planting date, and final planting date to ensure your crops are covered. It’s essential to have crop insurance in place before you suffer a loss.

2. A range of crops are

3. Cost calculators are

4. Can I afford crop

5. The 2014 Farm Bill expanded

6. New farmers have special

7. Combination coverage has

Again, if you’re unsure about the best crop insurance options for your farm or ranch, talk to your Farm Bureau agent about your options.

Join Our Family